Markets are cyclical by nature.

That shouldn’t be particularly revealing news to our community, which has witnessed this firsthand in the energy sector over the years.

Last April, the brief dip that oil prices took into negative territory as contracts rolled over was about as clear of a bottom as you’ll find in history.

You can bet that the smart money recognized this for what it truly was: a huge window of opportunity.

We’ve certainly taken advantage of that ebb and flow in the past.

And we’re doing it again right now.

I call it the great oil reset.

The Great Oil Reset

It’s safe to say that the investment herd doesn’t understand the precipitous repercussions that the COVID-19 pandemic will have on our oil sector.

Sure, I’ll bet your average person on the street could predict what was going to happen over the short term.

The fact that our streets and highways were empty was an omen of things to come.

Even the gridlock in Los Angeles disappeared, and surreal images like this seemed more apt in a post-apocalyptic world:

When demand plummeted, oil companies responded the only way they could.

They stopped drilling.

In the past, drillers would continue putting their rigs into the field to prevent sharp production declines.

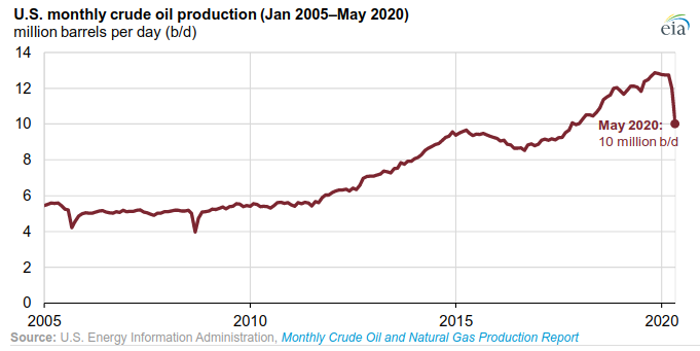

Just think, our domestic production had been ramping up for more than a decade leading up to the COVID-19 pandemic.

That’s how the United States’ crude output topped 12.7 million barrels per day as the country locked itself down in March.

I mentioned last week that the meteoric rise in oil production was due to the development of two key technologies that allowed companies to finally tap into a vast wealth of tight oil resources.

That’s the sole reason why I was able to fill up for two bucks per gallon this morning.

Unfortunately, there’s one huge catch here.

It will also mint a fortune for a small group of investors that recognizes this opportunity for what it is.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Crisis Meets Opportunity

When companies stopped drilling activity as they responded to the “new normal” of a COVID-19 market, our crude output fell to 10 million barrels per day during the first three months of the shutdown.

Take a look at that decline for yourself:

I’ve told you before that the consequences of halting oil exploration will be far harsher than most investors understand.

You don’t just magically turn the taps back on and expect our output to return to normal overnight.

Drillers aren’t in growth mode right now.

No, right now they’re in survival mode.

Despite this halt in drilling activity, gasoline demand is experiencing a V-shaped recovery. In fact, demand has not only returned to its mid-March levels but traders are starting to get very bullish.

You’ve heard me tell you before that the cure for low oil prices IS low oil prices.

More importantly, we should be taking full advantage of this reset.

I’ve put together a special investment briefing on a small, elite team of Texas geologists who struck pay dirt right under Wall Street’s radar. They now control exclusive access to nearly 4 billion barrels of Texas tea right beneath their feet.

But this is more than just having oil in the ground.

While the world’s attention has been focused on the COVID-19 pandemic, these guys put their drill bits into the ground and proved beyond all doubt that the massive volumes of crude under their feet can be extracted at a huge profit.

You need to see the details on this one for yourself.

Let me show you them right here.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.