This family-owned paper manufacturer might have had the best government contract of all time…

Crane Currency of Boston, MA, is a manufacturer of cotton-based specialty paper products. Most notably, it manufactures the paper used by the Federal Reserve for U.S. currency and passports.

And it’s been providing the U.S. government these services since the founding of the country.

In fact, the Crane family has been providing paper for currency since the late Colonial era. The first person in the Crane family to become a papermaker, Stephen Crane, sold currency-type paper to Paul Revere, who printed the American Colonies’ first paper money.

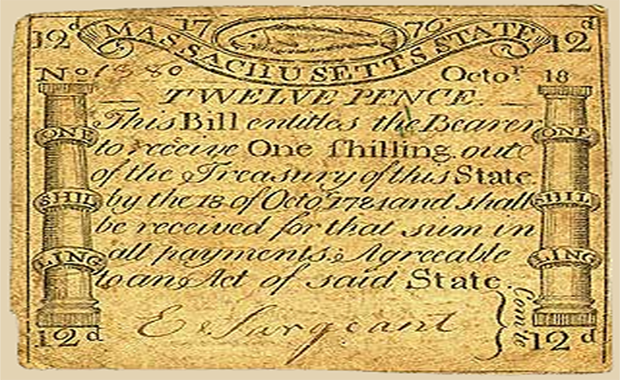

Paul Revere’s 1776 Massachusetts 1 Shilling

Paul Revere’s 1776 Massachusetts 1 Shilling

The Crane company has always been private. And it’s certainly been one heck of a contract for the business. But even if Crane was a public company in which you could invest, there’s no doubt that physical paper currency is rapidly losing favor today to digital payments and, to some extent, digital currencies.

A recent Gallup poll shows that only 24% of Americans say they are making all or most of their purchases with cash. That’s down from 36% just five years ago.

So although the Crane company has had a terrific business with the U.S. government for the past +240 years, the demand for their physical paper products is likely to drop.

Truth is, there are already more digital U.S. dollars than paper notes.

The Federal Reserve reports there are currently $1.52 trillion worth of physical U.S. notes in circulation. But if you include checking accounts, demand deposits, and other digital accounts, that figure is closer to $4 trillion.

Still, even though the opportunity to provide the government with physical paper products for currency might be dwindling, new opportunities are budding from digital currencies.

Bitcoin, for instance, introduced the world to the blockchain system. Blockchain is simply the digital ledger system used to record and constantly confirm digital currency transactions across thousands of private computers on a decentralized network. It’s the checks-and-balances system for digital currencies like Bitcoin.

The blockchain has been successful (for the most part) so far. And the fact is, every major financial institution and central bank, including the U.S. Federal Reserve, is currently researching blockchain and other forms of distributed ledger technologies to work into their own systems. But still, there could be bigger opportunities…

Imagine Owning the Printing Presses for Digital Currencies

Although it’s often overlooked, digital currencies do, in fact, need to be created. It’s not simply a matter of making a few keystrokes.

In fact, Bitcoin “mining” is actually a very energy-intensive process. Bitcoin’s current estimated annual electricity consumption is over 16 TWh. That’s enough to power almost 1.5 million U.S. homes.

Bitcoin is created when it is electronically earned (or “mined”) using specialized hardware, which are just generally called “miners.” Among the most popular digital currency miners on the market today is Bitmain’s Antminer S9, shown below.

These miners solve highly complex mathematical calculations to confirm previous Bitcoin transactions. As a reward for this service, the owner of the mining hardware earns a transaction fee in the form of new Bitcoin. This is essentially how new Bitcoin is created.

Companies that produce these miners like Bitmain are sort of the Crane Currencys of the 21st century. Unfortunately, all of the outfits that manufacturer these Bitcoin “printing presses” are also private. (I’d keep my Bitcoin printing press company private, too.)

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

But if we look a little deeper, we might find what we’re looking for…

You see, the most important feature to the mining hardware is the semiconductor chips inside.

Bitcoin miners use what are called application-specific integrated circuit (ASIC) chips. These chips are absolutely vital to the mining hardware. They are essentially the brains of the whole operation.

ASIC chip manufacturers currently include firms like Analog Devices, Inc. (NASDAQ: ADI), Maxim Integrated Products, Inc. (NASDAQ: MXIM), and Qualcomm Inc. (NASDAQ: QCOM).

But I’ve found one company that produces nearly 80% of all the ASIC chips that are going into these miners.

Now, here’s the best part…

It doesn’t matter whether the price of Bitcoin or other digital currencies goes up or down; the system will always need these ASIC chips. So the companies that create these special chips are in a great position.

Bitcoin and cryptocurrency miners are creating money.

Let me ask you this…

What is the demand for money?

Is it anything less than infinite?

Owning ASIC chip manufacturers is akin to owning the means of production for money. You own the money and the printing press.

I need to wrap up for today. But if you’re interested in learning more about this ASIC chip stock, just click here.

Until next time,

Luke Burgess

As an editor at Energy and Capital, Luke’s analysis and market research reach hundreds of thousands of investors every day. Luke is also a contributing editor of Angel Publishing’s Bull and Bust Report newsletter. There, he helps investors in leveraging the future supply-demand imbalance that he believes could be key to a cyclical upswing in the hard asset markets. For more on Luke, go to his editor’s page.