Elon Musk woke up one day last January a little differently than usual.

His routine was the same, catching up on emails, phone calls, and jumping into strategy meetings — all before lunch.

Yet there was a little pep in his step that morning, a smirk staring back at him in the mirror as he shaved.

You see, that day Elon Musk woke up with a net worth of $185 billion.

And what made it special was that it was the first time he was officially the richest person on the planet. He finally managed to surpass Jeff Bezos’ own fortune.

And while Bezos’ net worth has swelled to over $191 billion, the Tesla magnate is still ahead by a small $9 billion margin.

There’s only one way he’ll manage to stay on top.

He’s already told us how.

Look, sometimes we take things for granted.

I’m just as guilty of it as you are, even despite our best efforts to avoid doing so.

Do you want to know why we do it?

It’s because we blanket ourselves in a sense of security over something and trick our minds into believing that we’ll never lose it.

Let me tell you something that every one of us takes for granted today: energy.

You might not think so at first; I didn’t.

Just ask yourself, “Where does the power come from that allows me to read this right now?”

Are you on your phone? Perhaps a computer? Maybe a laptop, iPad, watch, or any other fantastical device available to us today?

If you’re like every other person around you, you may have no idea where that power comes from and just take it for granted like the rest of us.

I’m also willing to bet you missed it late last year when Elon Musk exposed the U.S. energy sector’s darkest secret.

I don’t blame you, especially considering the fact that our news headlines have been dominated by COVID for nearly two years.

However, last December, Musk made a bold prediction that global demand for electricity will have to double in order for us to fully transition to electric vehicles.

He was quick to add that this means expanding our use of renewables like solar, wind, and geothermal.

However, he also mentioned the one source of energy that can actually deliver electricity on the scale needed for a complete EV takeover — nuclear power.

Nuclear Outlook 2022: The Secret to Protecting Musk’s $200 Billion Fortune

How important is nuclear power to our electrical generation?

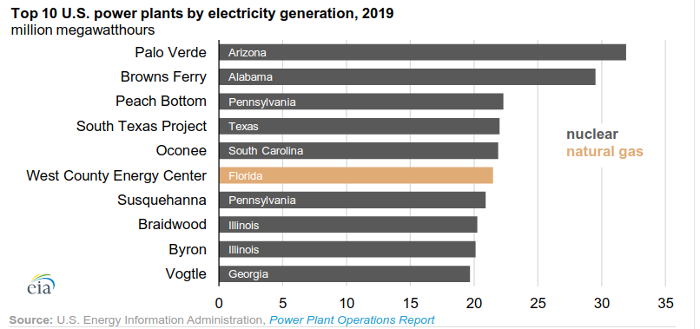

Put it this way — 9 out of the 10 largest power plants in the United States in 2019 were nuclear plants.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.The Best Free Investment You’ll Ever Make

Together, these nine plants generated over 200 million MWh of pure, emission-free electricity that year.

We already know that nuclear power is arguably the safest and cleanest energy source available to us and that it is incredibly reliable — far more so than wind and solar, both of which struggle with issues of intermittency.

In total, nuclear power plants have been supplying us with roughly 20% of our electricity for decades, with a dozen states relying on nuclear for one-third of their electricity demand and three states even satiating more than half of their power demand from nuclear plants.

What’s surprising is that this industry has become more and more efficient as technology advances.

In fact, nuclear power generation has increased by 40% without the addition of a single new reactor, all thanks to boosting the capacity of current reactors.

Since 2000, our nuclear plants have been operating at 90% capacity.

However, the nuclear industry is about to undergo a dramatic evolution over the next few years.

Not only will it be nearly unrecognizable from today’s nuclear plants but this shift is taking place quicker than you might think.

In 2022, the key to owning this market is keeping up with the new technology being deployed, and it may all come down to the expansion of small modular reactors (SMRs).

Keep in mind that this isn’t some pipe dream.

Last summer, China started constructing “Linglong One,” its first SMR that will be both cheaper and quicker to build than the large nuclear plants we see today.

Here in the United States, Rolls-Royce is pitching its own SMRs for companies to hyperscale their data centers with emission-free electricity.

Even Bill Gates is locked into SMR technology by funding companies like TerraPower.

But I’ve told you time and again that the opportunity here isn’t in building tomorrow’s advanced nuclear reactors — the smart money is in fueling them.

All I can show you is the door.

You’re the one who has to walk through it.

You’ve got to check this one out for yourself firsthand.

Until next time, Keith Kohl A true insider in the technology and energy

markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new

technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the

Managing Editor of Energy & Capital, as well as the

investment director of Angel Publishing’s

Energy Investor and Technology and

Opportunity. For nearly two decades, Keith has been providing in-depth coverage of the hottest

investment trends before

they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution

currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on

key advancements in robotics and AI technology. Keith’s keen trading acumen and investment research also extend all the way into

the complex biotech sector,

where he and his readers take advantage of the newest and most groundbreaking medical therapies being

developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s

to lab scientists grinding out the latest medical technology and treatments. You can join his vast

investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.