It’s expected to become a $4 billion business by 2022.

And that’s just in the U.S. and Canada.

The global estimates for cannabis edibles could effectively double that number.

I know some folks don’t like to talk about weed or edibles. But if you want to make a ton of cash from the cannabis boom, you need to pay attention to the edibles market.

This Isn’t Your Father’s Edible

Forget everything you know about the old days of edibles.

Foul-tasting pot brownies and melted peanut butter and cannabis crackers are a thing of the past.

Today, there are literally thousands of edibles available throughout the world. And they come in all shapes, sizes, and varieties.

We’re talking everything from white cheddar popcorn and honey mustard pretzels to organic cannabis-infused teas, pomegranate-flavored mints, and high-end infused dark chocolate.

For me, you simply can’t go wrong with Défoncé Chocolatier’s dark chocolate bar.

Each bar contains 90 milligrams of THC, and the company sources only the finest chocolate and cannabis around. If it were a public company, I’d own shares. But it’s not.

Truth is, there really are only a couple publicly traded edibles companies you can invest in.

The first is PLUS Products (OTCBB: PLPRF), which is arguably the fastest-growing edibles brand in California.

According to BDS Analytics, during 4Q 2018, PLUS Products secured its position as the number one best-selling cannabis-infused edibles brand in California and saw its lead over the number two brand widen over the prior quarter. The company also had three of the best-selling branded products in all product categories including flower, vaporizers, edibles, and topicals.

Take a look:

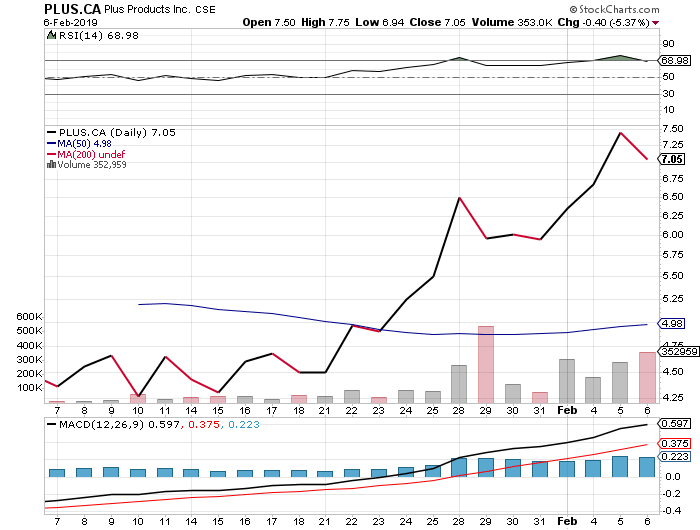

The stock has done quite well since the start of the year, as you can see here:

PLUS Products is currently gearing up for a major expansion, too. It has plenty of cash and a nice amount of momentum going forward. I actually own shares myself.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

$2 Billion up for Grabs

Another publicly traded edibles brand to keep an eye on is Dixie Brands (OTCBB: DXBRF)

Dixie Brands has the broadest portfolio of revenue-generating consumer-facing products in the market. And unlike a lot of edibles brands, Dixie is a multi-state operator, with current footprints in California, Colorado, Maryland, and Nevada.

The company also announced last month that it formed a joint venture with Khiron Life Sciences (OTCBB: KHRNF) that will allow it to bring its edibles to the Latin America market. And just yesterday, it was announced that Dixie landed another joint venture to get into the Michigan market.

The Michigan market is huge, by the way. It’s estimated to generate more than $2 billion a year, so clearly having access to this market is going to go a long way to strengthening Dixie’s bottom line.

Both PLUS Products and Dixie Brands are major players, and their first-mover advantages will take them far this year as the edibles market heats up — not just in the U.S., but in Canada as well, where edibles will finally become legal this year.

Of course, there will be new ways to play the rush on edibles in 2019. In fact, I’m investigating a new edibles play right now that I plan to share with members of my Green Chip Stocks investment community in a few weeks.

I was actually tipped off to this stock by my S-50 trading algorithm. This is the same algorithm that tipped me off to some of our biggest winners to date. I’m talking about:

- OrganiGram Holdings (TSX-V: OGI) — 1,185% gain

- MariMed (OTCBB: MRMD) — 504.48% gain

- Aleafia Health (TSX-V: ALEF) — 217.28% gain

- Aphria, Inc. (TSX: APHA) — 1,174.34% gain

- Canopy Growth Corporation (TSX: WEED) — 3,015.63% gain

You can get some of this action, too, by clicking this link and becoming a member of my private investment community today.

You can also check out the details of my pot stock investing strategy that has led to literally dozens of double- triple-, even quadruple-digit gains.

Given my track record, it would make sense to at least see how I’ve been able to make so many investors like you so incredibly wealthy by investing in the legal cannabis market.

To a new way of life and a new generation of wealth…

Jeff Siegel

Jeff is an editor of Energy and Capital as well as a contributing analyst for New World Assets.

Want to hear more from Jeff? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@JeffSiegel on Twitter

@JeffSiegel on Twitter