“Buy when there’s blood in the streets, even if the blood is your own.”

History generally attributes this legendary saying to Baron Nathaniel Mayer Rothschild.

The story, as it’s often told, goes as follows…

After the Battle of Waterloo, Rothschild used advance information about the British coalition’s victory in Belgium to profit greatly off United Kingdom gilts. U.K. gilts are the equivalent of U.S. Treasury bonds, and Rothschild, privy to the information before most, positioned himself long on these gilts.

As word finally began to spread about Napoleon’s defeat, British stocks and bonds soared, and Rothschild made a killing.

Now, the reason Rothschild is accredited with saying “Buy when there’s blood in the streets” is because prior to the public (and many financial and government magistrates) learning the outcome of Waterloo, news of several British defeats at Napoleon’s hands had pervaded the public narrative.

So there was a palpable fear that the British would lose a very costly war, which sparked a frenzy of selling, driving asset prices into the basement. However, thanks to his intricate network of private couriers, Rothschild knew the information about Commander Wellington’s victory at Waterloo was true.

In order to capitalize on this confusion, he bought up all the depressed assets he could. He then sold them at exponentially higher prices after the truth came to light, and British assets soared in value… or so the legend goes.

My point is that the best time to buy and trade financial assets is when folks are panic selling.

That’s precisely what the investment herd is doing right now.

The recent end of April’s sell-off left a lot of blood on Wall Street, but we can apply the Rothschild lesson to thrive off the volatility.

Investors Hate Volatility, but Traders Thrive off It

Take a look at this stock heat map from this week. It doesn’t take a rocket scientist to know investors are getting hammered right now.

Traders on the other hand, especially the unique group of Wall Street players known as Naked Traders, are raking in cash, even as stocks are free falling.

Why?

In short, traders thrive off of volatility.

How so?

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

When it comes to trading stocks and options, change is good. When stock market volatility is high, it means a lot of changes.

To make money in the financial markets, we need changes. Specifically, we need the price of “X” to go higher. The speed of these changes, or the rate of change, is how we measure whether markets are volatile or not.

The higher the rate of change, the higher the volatility, and vice versa. As volatility, or the rate of change, increases, the overall number of potential profit opportunities also increases.

This is how individual investors like us can thrive during these volatile bear markets.

And no one does this better than my colleague and cubicle cellmate, Sean McCloskey.

Usually it takes an impressive string of winners to stand out to me, especially considering the incredible run the energy sector has had throughout the pandemic.

However, this morning I happened to peek across my desk and immediately recognized the smile on Sean’s face. You see, he had his latest trading activity for his Naked Trades community up on his screen.

Let me give you a sneak peak of what made him so happy during a market crash:

- 51% on Walmart

- 205% on Petrobras

- 124% on the VIX

- 84% on Baker Hughes

- 157% on Denison Mines

- 133% again on Petrobras

- 119% on Pfizer

- 130% on Uranium Energy Corp.

Keep in mind that these are just the trades they’ve made this year!

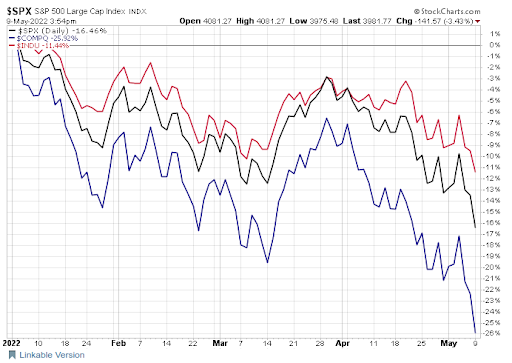

And all while the Nasdaq is down a whopping 27%, the S&P 500 is down 17%, and the Dow is down 12%!

This may sound incredible, even downright dishonest, but I assure you these are real gains made by real people with a system that’s as easy to use as playing a game of checkers!

So I have to ask: Do you want to roll over like the rest of Wall Street or do you want to take control of your financial future?

Today, I’m going to show you how you can do the latter.

As a premium member of Energy and Capital, you’ve been privy to some of the best trading strategies in today’s market. And it’s in that spirit that I want to give you early access to Sean’s playbook.

It took months, but we finally convinced him to give all the members of our investment community a firsthand look at how he can trade so successfully despite the river of blood flowing in the market right now.

Sean breaks it all down for you.

So if you’re the kind of person who’s ready to recognize and seize incredible opportunities, here’s your invitation to join us for our Best Trading Year Ever special event.

Sean will be sending more details over the coming days, but most importantly, The Best Trading Year Ever starts on May 17 at 3:00 p.m. ET.

Reserve your spot here. I sincerely hope to see you at this momentous event.

Until next time, Keith Kohl A true insider in the technology and energy

markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new

technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the

Managing Editor of Energy & Capital, as well as the

investment director of Angel Publishing’s

Energy Investor and Technology and

Opportunity. For nearly two decades, Keith has been providing in-depth coverage of the hottest

investment trends before

they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution

currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on

key advancements in robotics and AI technology. Keith’s keen trading acumen and investment research also extend all the way into

the complex biotech sector,

where he and his readers take advantage of the newest and most groundbreaking medical therapies being

developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s

to lab scientists grinding out the latest medical technology and treatments. You can join his vast

investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.