From ancient Egypt to the California Gold Rush to the present day, we have been mesmerized by gold for everything from its shininess and beauty to its status as a universal indicator of wealth and its value as a safe haven for riches.

While modern history holds that an ounce of gold is always enough to buy a decent men’s suit, suggesting that its price trends with the fashion industry, the precious metal’s value has been recognized solidly since 3,000 B.C., when ancient Egyptian pharaohs and priests worshiped its beauty, but they would never have bartered with it or thought of it in terms of material gain. It certainly wouldn’t have gone to buy a “decent men’s robe.”

While modern history holds that an ounce of gold is always enough to buy a decent men’s suit, suggesting that its price trends with the fashion industry, the precious metal’s value has been recognized solidly since 3,000 B.C., when ancient Egyptian pharaohs and priests worshiped its beauty, but they would never have bartered with it or thought of it in terms of material gain. It certainly wouldn’t have gone to buy a “decent men’s robe.”

From the Egyptian priests to the ancient Greeks — who solidified gold as a status symbol and form of glory — we get all the way to 1792, when the history of gold changed forever with the U.S. Congress’ Mint and Coinage Act. A fixed price for gold in terms of U.S. dollars was established, rendering gold and silver coins legal tender.

An Ounce of Gold During the Gold Rush

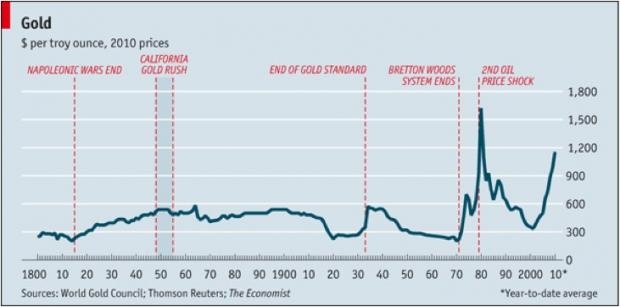

Flash-forward considerably to 1848, when the first gold was discovered at Sutter’s Mill, California, and the Gold Rush ensued, captivating us all until the present day. This is the definitive year when it was clear that gold would become the purest indicator of wealth the world over.

Until about 1946, the price of gold remained largely unchanged, coming in at $20.67 per ounce, which would be equivalent to almost $400 today.

Shopping with an ounce of gold in the 1800s and first half of the 1900s could get you any one of these things:

- 2 cows

- 10 acres of land in South Carolina

- 2 dozen pairs of Levis

- 20 tickets to the opera

If you had a bar of gold, for which the standard of Fort Knox fame is 400 ounces, you could buy:

If you had a bar of gold, for which the standard of Fort Knox fame is 400 ounces, you could buy:

- 13 Oldsmobiles

- 35 Harley Davidsons

- An average home in Brooklyn, NY

From the 1950s to the mid-1990s, gold prices per ounce were around $35. In 1975, you would have needed about 37 ounces of gold to buy an Apple II computer, but you couldn’t get even a quarter of a microwave.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

What to Buy with an Ounce of Gold Today

The price of gold since then has become much more attractive. In 1996, the price of gold shot up to almost $370 an ounce. By 2008, it was around $870; by 2011 it was $1,531 (but did reach $1,900), and today, it’s around $1,200 per ounce.

In 1950, you could feasibly have purchased a house with this much money, but today it’ll only get you a week at an Airbnb.

You can, however, still get a “decent men’s suit” — after all, this age-old comparison still fits — but it’s not going to be bespoke. Even two thousand years ago under the Roman Empire, an ounce of gold bought the average Roman citizen a toga, belt, and sandals.

And at today’s prices, a $1,200 ounce of gold could get you almost a dozen cows — a real cattle bonanza compared to the 1800s.

Gold is a safe haven investment, not a value-creating one necessarily. It’s what you buy and where you put your money when global chaos threatens markets, when instability rules the day, and when the dollar looks unattractive.

If you have an ounce of gold today you might consider buying this: one bitcoin, the rising currency of our time. Bitcoin, the digital currency, was invented only in 2008 but has outperformed every other currency since then, with the exception of 2014, when it tanked and then recovered.

If you have an ounce of gold today you might consider buying this: one bitcoin, the rising currency of our time. Bitcoin, the digital currency, was invented only in 2008 but has outperformed every other currency since then, with the exception of 2014, when it tanked and then recovered.

In late February this year, Bitcoin hit a record, soaring above $1,300 on March 10th ahead of regulatory approval for the first Bitcoin exchange-traded fund (ETF) in the U.S. In the end, it didn’t get the approval, but it’s pulled through before, and it really loves chaos — perhaps even more than gold does. Forbes even calls it a “fear gauge” of public faith in fiat currencies and central banks.

So, what can your ounce of gold buy you today? In many ways — even beyond the steadfast “decent men’s suit” — pretty much the same thing.

History is pretty clear on this…

As far back as 400 B.C., scholars say that under the reign of King Nebuchadnezzar, an ounce of gold bought around 350 loaves of bread.

Today, though our bread choices are a bit overwhelming, your ounce of gold will buy you close to the same amount, but the preservatives will make it last a lot longer.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.