The U.S. is facing an energy crisis unlike many have seen before.

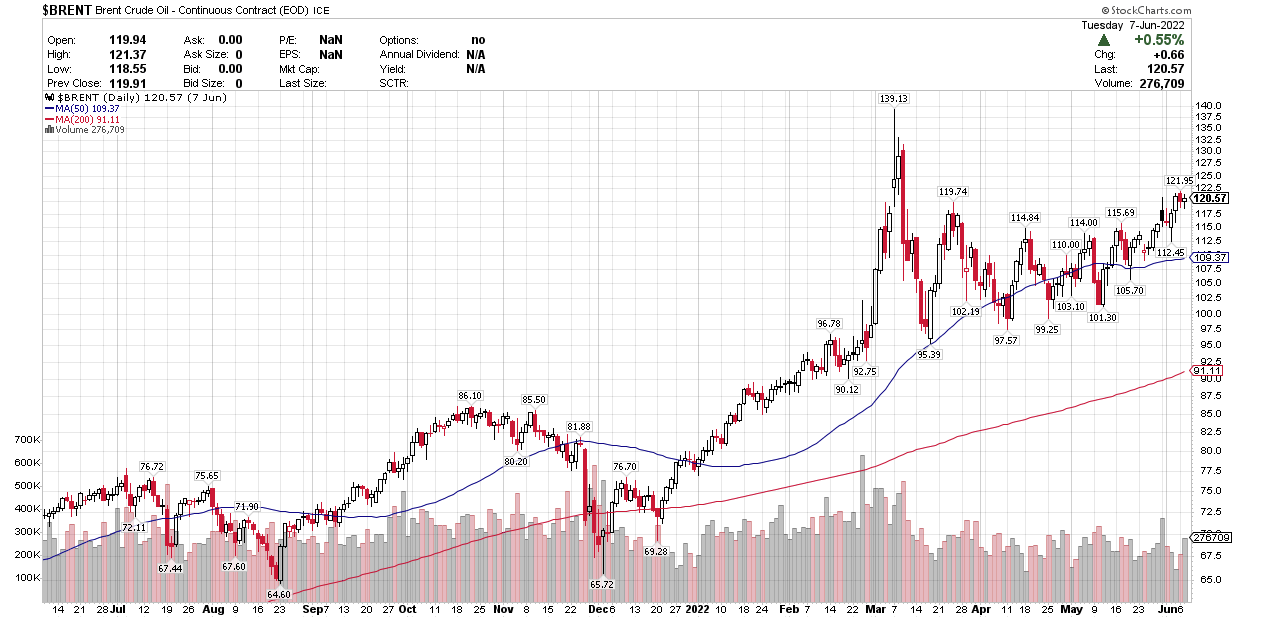

Gas prices are surging, Brent crude is at $120 per barrel as I type, and West Texas Intermediate (WTI) crude is just a hair behind. Many experts are now predicting that oil and gas prices will spike even higher as China reopens after months-long COVID lockdowns.

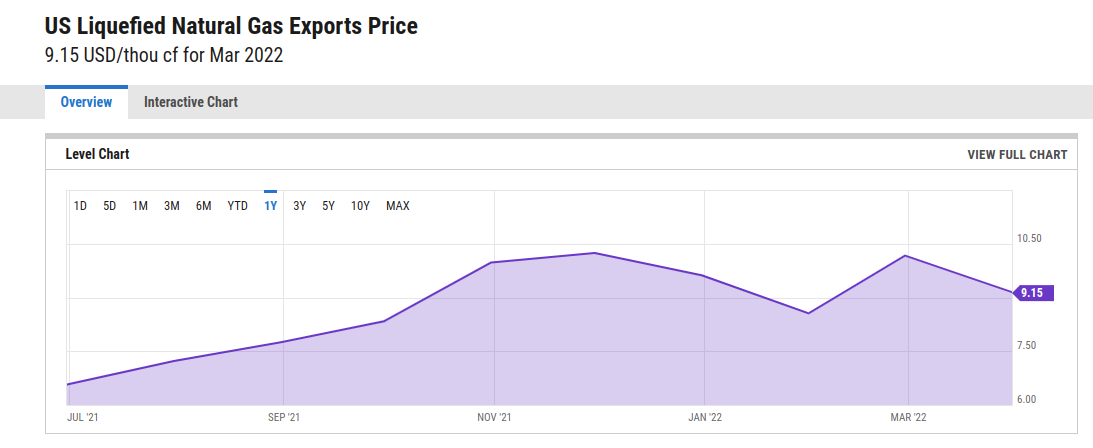

U.S. LNG prices are also up 55% from the same time last year.

But perhaps even more concerning is the fact that many power companies are warning that demand is putting too much pressure on our outdated and undermaintained power grid.

A recent Reuters report notes:

Power outages over the last six years have more than doubled in number compared to the previous six years, according to a Reuters examination of federal data. In the past two years, power systems have collapsed in Gulf Coast hurricanes, West Coast wildfires, Midwest heat waves, and a Texas deep freeze, causing long and sometimes deadly outages.

But Wait! There's More (Bad News)!

And just the other day, an editorial in The Wall Street Journal stated:

Last week the North American Electric Reliability Corporation (NERC) warned that two-thirds of the U.S. could experience blackouts this summer.

In my neck of the woods, the Baltimore-Washington area, home to some of the richest (and poorest) folks in the U.S., we've already had a number of power problems, from transistor explosions to downed power lines from strong storms.

In my parents’ neck of the woods, the Southeastern U.S., hurricane season is just getting started.

Oh, and did I mention an extra-hot summer is forecast for the entire U.S.?

A New York Times article summarizing a National Oceanic and Atmospheric Administration report from last week notes:

The agency said that above-normal temperatures are likely across almost all of the lower 48 states in June, July, and August, except for small areas in the Pacific Northwest and Northern Plains.

With all those extra air conditioners running at full tilt, we’re going to put more pressure on our shaky grid this summer.

As a result, energy prices are going to surge to unprecedented highs this summer!

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.The Best Free Investment You’ll Ever Make

Three Stocks You Need to Own During this Unprecedented Energy Crisis

When the volatility continues into the summer, the American energy crisis will make the gas crunch in the 1970s look like a day at the beach.

There’s no doubt in my mind that Americans will pay as much as $6–$7 per gallon at the pump by Labor Day. As prices rise during the summer, 1970s-style gas lines and shortages are highly likely.

There’s only one place the world can turn to for more supply: the U.S.

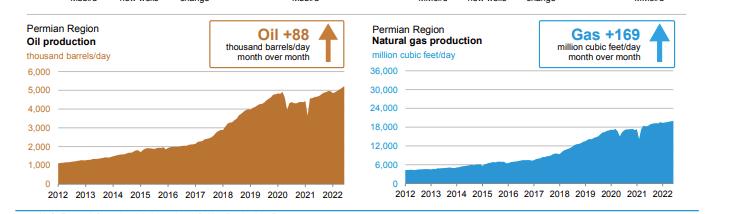

According to the U.S. Energy Information Administration:

And more specifically, the largest bulk of new oil and gas will come from the U.S.’ Permian Basin.

That’s why, in this special report, oil and gas expert Keith Kohl has outlined the three best oil stocks you want to own right now before these companies' share values start to surge.

Not only will these companies help investors profit from the flood of U.S. oil that’s on its way but they'll also give you a way to profit handsomely from the geopolitical instability.

To your wealth, Sean McCloskey After spending 10 years in the consumer tech reporting and educational publishing industries, Sean has since redevoted himself to one of his original passions: identifying and cashing in on the most lucrative opportunities the market has to offer. As the former managing editor of multiple investment newsletters, he's covered virtually every sector of the market, ranging from energy and tech to gold and cannabis. Over the years, Sean has offered his followers the chance to score numerous triple-digit gains, and today he continues his mission to deliver followers the best chance to score big wins on Wall Street and beyond as an editor for Energy and Capital.

Editor, Energy and Capital

@TheRL_McCloskey on Twitter

@TheRL_McCloskey on Twitter