Oil wants to go higher… if only it can just get over this pesky banking crisis.

Or perhaps the headlines you’ve been reading are pointing to other boogeymen that are determined to keep a lid on oil prices. You know, the hyperbolic clickbait lines that steal your attention and distract you from an ever-tightening oil balance.

I told you before that the only thing that can truly stop oil prices from surging higher are fears of a historic global recession — that fear is palpable in the market today.

However, there’s no sign of any such major slowdown here in the United States, and we’re STILL consuming around 20 million barrels of petroleum products per day. Our thirst for crude oil products has been relatively flat for decades, too!

Gasoline demand is over 2.2% higher year over year; demand for diesel is climbing higher as well. However, our stockpiles of both these fuels are well below the five-year average.

But here’s the thing…

When you see what’s coming down the road in 2023, the absurdity can seem maddening. In fact, we’ve talked before about the wildly bullish case for oil opening up in the second half of the year.

Now it’s time to recognize this buying opportunity for what it is.

Oil Outlook H2 2023

Yesterday, West Texas Intermediate was trading under $72 a barrel.

There are several critical points to make about this key price level.

You see, every day that passes by with crude oil below $72 a barrel puts President Biden’s back against a wall… particularly since he announced last year that he would look to refill our Strategic Petroleum Reserve between $67 and $72 per barrel.

The last time oil prices were well within this range, Biden’s energy secretary told us they wouldn’t be too hasty refilling the SPR and that it’s a long and arduous process. Granted, that statement infuriated the Saudis and led to OPEC+ cutting oil output in retaliation.

Here we are back in that price range again, yet we’re doing quite the opposite of refilling the SPR.

Last week we sold off another 2.9 million barrels. However, before you start screaming at your screen, just keep in mind that this sale was in the works well before Biden’s historic drawdown strategy last year.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Now let me show you where Biden misstepped.

Rather than announcing that the government was buying up oil — within his price range — right now, we were told the plan is to fill it up later this year.

There’s just one problem: We’re NOT going to see oil below $72 this upcoming summer, fall, or winter!

Unlike the second half of last year, we’re dealing with much tighter fundamentals.

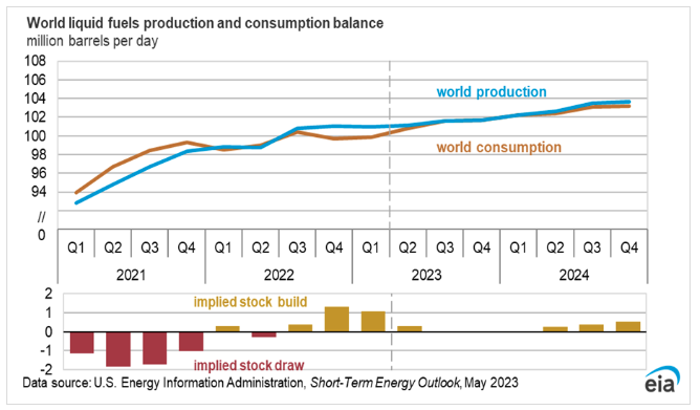

Take a look at the latest projections for global supply and demand from the Energy Information Administration:

Currently, the EIA believes that global consumption will rise by 1.6 million barrels per day this year and then grow by another 1.7 million barrels per day in 2024. Like everyone else, EIA officials expect nearly all of that growth to take place in India and China.

Meanwhile, the EIA is calling for global supply to increase by 1.5 million barrels per day this year.

Let me ask you: Where do you see oil prices going once the summer driving season is fully underway, or if the Russian-Ukrainian war exacerbates, or if China’s economy grows far faster than current projections?

By the time oil climbs back into the $80s and starts threatening $90 per barrel or, God forbid, another run into triple digits, President Biden will be wishing he snapped up crude this cheap.

Mark my words — $70 oil is money in your pocket.

All you have to do is know where to look.

Fortunately, I can help your search get started.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.