The 5G promise is very real.

A ResearchAndMarkets report notes:

Post-COVID-19, the 5G infrastructure market is estimated to grow from $12.6 billion in 2020 and projected to reach $44.9 billion by 2025, at a CAGR of 28.97%.

When the story first hit the mainstream in 2017, however, the practical applications for 5G were few and far between. This left big questions for investors looking to park funds in this explosive growth story ahead of the herd.

The traditional players were obvious out of the gate. Telecom names like Verizon Communications Inc. (NYSE: VZ), T-Mobile (NASDAQ: TMUS), and formerly Sprint (NYSE: S) offered investors the chance at some decent gains — with the right timing. Moving forward, more and more big tech names have offered fast and easy gains to shareholders as they better position themselves to facilitate the 5G revolution.

One of my favorite early plays on 5G was Taiwan Semiconductor (NYSE: TSM). Back in 2016, TSM procured an incredible partnership with Apple to produce its A-10 64-bit ARM-based processors. By 2018, TSM had essentially become Apple’s most important chipmaker. Readers of mine who took my advice to grab shares of TSM back in August 2018 are sitting on gains of over 200% today.

Of course, TSM wasn’t the only company offering nice gains in line with the 5G promise.

But there’s a lot more to the 5G revolution than meets the eye, and that means a lot of opportunities folks could overlook.

5G Infrastructure Is the Segment That Will Mint the Most 5G Millionaires

5G enables an incredible amount of other new technologies — ones that will revolutionize the world.

Driverless cars, spatial computing, new ages of space exploration, medical innovations, and never-before-seen entertainment experiences are just the tip of the iceberg. The companies facilitating the growth of these technologies could offer early investors the chance at generational wealth.

That’s why building out the global 5G infrastructure is going to be huge, too. This story isn’t just about internet of things devices and other end users’ experiences. Take for instance another company I recommended to my readers in 2018.

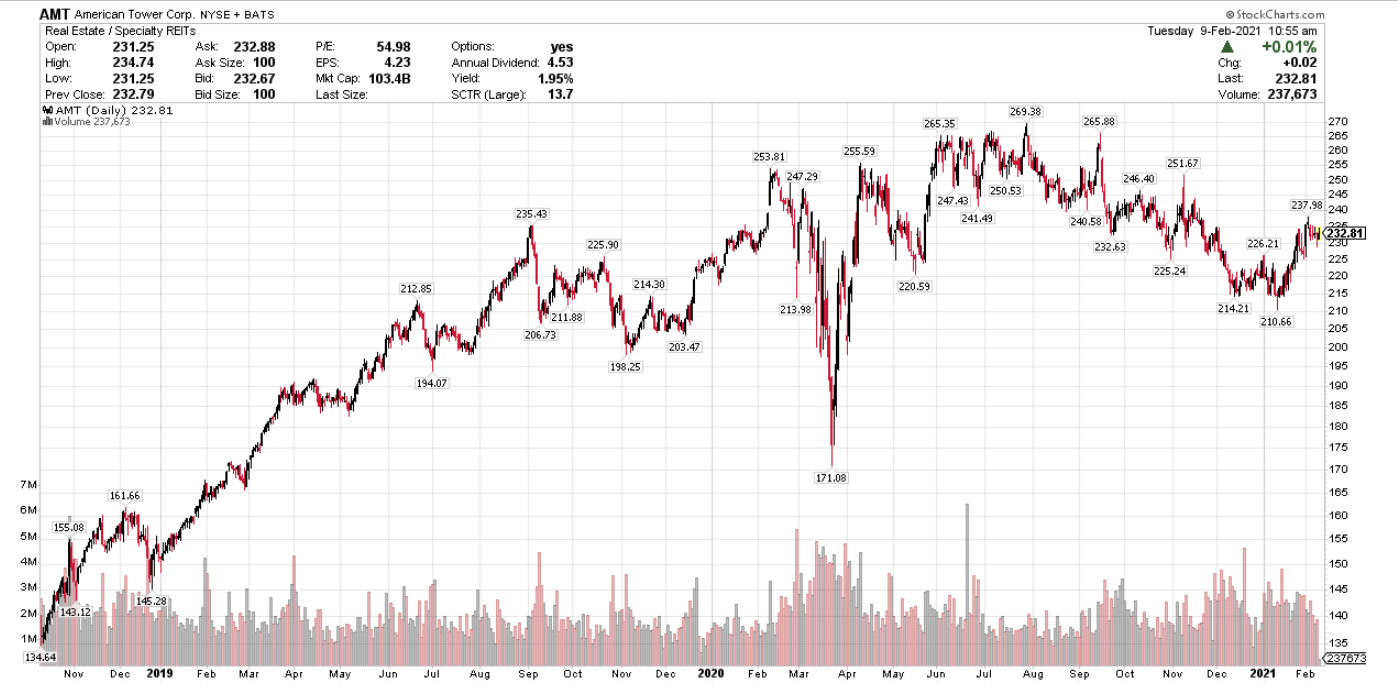

American Tower Corp (NYSE: AMT) is one of the leading wireless infrastructure firms in the world. Specifically, AMT is a real estate investment trust (REIT) that owns and operates tens of thousands of cell towers on five continents. As the 5G revolution took hold, so did AMT’s stock. And even though shares suffered greatly during the pandemic shutdown, investors who still own the stock today are up 60%.

The sheer size of the 5G market — and the need for completely new infrastructure from top to bottom — means moving forward, there will be even better and more lucrative opportunities to take advantage of.

To make 5G work as promised, we need a massive overhaul of our communication infrastructure. This requires all types of new circuitry, transmitters, frequency filters, switches, splitters, batteries, wiring… which brings us to the biggest 5G opportunity I’ve ever seen.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

The Biggest 5G Story of 2021

You won’t hear about this company — or about the tiny 5G device it makes — anywhere in the mainstream media.

But this one company’s hardware — thanks to a government-mandated program my colleague and market expert Keith Kohl calls 5G-Volta — is about to become a vital component in the next stage of the 5G revolution. 5G-Volta will be at the core of our national defense, vital emergency services, critical infrastructure, and virtually every other aspect of our economy. The company providing the technology to make this initiative happen should also see a meteoric rise in value.

According to my research, the 5G-Volta deployment will require at least 101.64 million of this company’s transmitters. As a result, it could also offer investors triple- and even quadruple-digit returns.

Here’s how the technology works.

The amount of energy needed to power advanced 5G networks will reach levels never before seen by energy and infrastructure experts. Making matters even more complicated is the fact that our energy grid is completely out of date.

There are millions upon millions of potential points of failure across 450,000 miles of high-voltage transmission lines and 5.5 million miles of local distribution lines. According to the Pew Charitable Trusts, the U.S. “experiences more electric outages than any other developed nation.”

In total, it’s estimated the U.S. economy loses $150 billion per year due to power grid failures.

That is simply unacceptable.

Thankfully, 5G-Volta provides the solution.

As part of the rollout, special 5G microsensors set on tiny modules no bigger than a few grains of salt will soon be added onto 1.58 million high-voltage transmission towers, in 55,000 substations, and over 100 million utility poles across the country.

On top of that, this new technology will eventually roll out to 128.58 million American homes, 18.6 million commercial customers, and 840,321 industrial customers. This is a massive undertaking.

That’s why 5G-Volta could be 24,866% bigger than “standard” 5G. And the company behind these secret 5G devices could hand fast-moving investors a chance at extraordinary returns on their investment.

Keith explains everything in detail right here.

To your wealth, Sean McCloskey After spending 10 years in the consumer tech reporting and educational publishing industries, Sean has since redevoted himself to one of his original passions: identifying and cashing in on the most lucrative opportunities the market has to offer. As the former managing editor of multiple investment newsletters, he's covered virtually every sector of the market, ranging from energy and tech to gold and cannabis. Over the years, Sean has offered his followers the chance to score numerous triple-digit gains, and today he continues his mission to deliver followers the best chance to score big wins on Wall Street and beyond as an editor for Energy and Capital.

Editor, Energy and Capital

@TheRL_McCloskey on Twitter

@TheRL_McCloskey on Twitter