1) Cryptocurrency

Bitcoin just jumped back through the $50,000 level yesterday. It was bouncing back from the recent low of $31,796.81 that it hit on July 12, 2021, and it’s up from $9,916 from the start of the year. For the record, I first recommended Bitcoin at $459 five years ago.

Bitcoin and other mainstream cryptocurrencies have been on a tear but there is value to be found in unique, niche cryptos that solve specific problems. I’ve found three that are trading for less than $1.00 that have tremendous upside. Sure, there are risks, but if you are going to speculate, this is where you should put your money.

In Q4, small-value crypto coins will beat the big guys in terms of gains. Just look at these returns for the year:

- Dogecoin (DOGE): +9,412%

- Cardano (ADA): +2,218%

- Binance (BNB): +2,174%

- Solana (SOL): +2,128%

- Ethereum (ETH): +756%

- Uniswap (UNI): +593%

- Polkadot (DOT): +591%

- XRP (XRP): +348%

- Bitcoin (BTC): +332%

- Litecoin (LTC): +214%

- Bitcoin Cash (BCH): +142%

- Chainlink (LINK): +92%

2) The Metaverse

Mark Zuckerberg, the CEO of Facebook (NASDAQ: FB), thinks that the metaverse will be the next killer app. It is where he will focus the next leg up in growth for the $1.03 trillion company.

Zuckerberg recently said, “In the coming years, I expect people will transition from seeing us primarily as a social media company to seeing us as a metaverse company.”

What is the metaverse? The term was first coined by sci-fi novelist Neal Stephenson in 1992 in his novel Snow Crash. It is a portmanteau of “meta,” meaning transcendent, and “verse” from universe.

Zuckerberg means you will use virtual reality to conduct meetings and socialize using enhanced virtual reality. Key components to building this will be sensors, virtual reality glasses, big data, artificial intelligence, supercomputers, and global high-speed infrastructure.

I first recommended metaverse, or what I call spatial computing, stocks last year. One company jumped over 450% because it developed a virtual reality training system for the proper transport and storage of COVID-19 vaccines. It is also involved in military testing and training for systems, weapons, and even social justice causes like sexual harassment.

This stock has since sold off, which means it could be the perfect time to pick up some shares. Check out the metaverse here.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.The Best Free Investment You’ll Ever Make

3) Supply Lines

It is no secret that supply lines are all messed up. Used cars are selling for record amounts because they can’t get computer chips. In China, the second- and third-largest ports are shut down due to a resurgence of COVID-19. Fifty container ships are stacked up at Ningbo port alone.

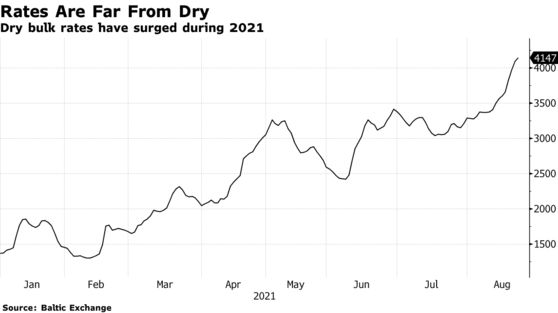

Dry bulk shipping rates are leaping higher.

Container shipping rates are rising right along with them. The pandemic coincided with a secular low in new ships coming online.

Demand is expected to outpace supply for at least the next 18 months, and shipping companies are extremely undervalued with low price-to-earnings ratios and high dividends due to a 10-year bear market in the sector.

The last time you saw surging commodity prices and low demand was in the mid-2000s. The Baltic Dry Index went from a low of 443 to a high of 11,482. You should consider investing in some shipping stocks.

All the best,

Christian DeHaemer Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.