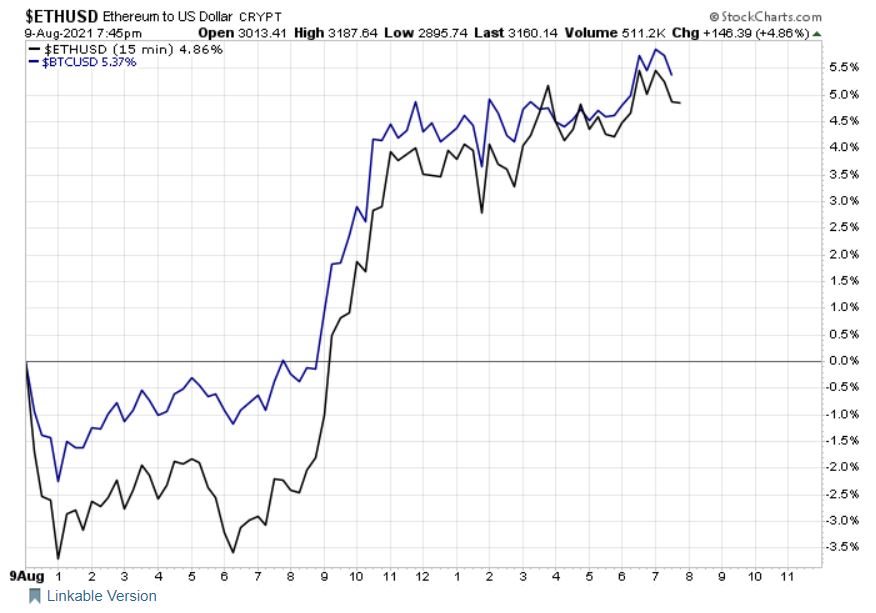

Crypto prices are soaring this week, with the benchmark token Bitcoin (BTC) leading the latest surge, rising over 5% on Monday and surpassing the $45,000 mark for the first time since May.

Ethereum (ETH), the second-most traded cryptocurrency by volume, was also on the move Monday, rising nearly 6% on the day to a price of roughly $3,100 by afternoon trading.

Holders of popular alternative cryptocurrencies also benefited from the surge. Dogecoin (DOGE) for example, the popular meme and NFT token, was up over 8% Monday.

The surge in crypto also caused a big rise in crypto-related equities. Riot Blockchain Inc. (NASDAQ: RIOT) was up over 12% by Monday afternoon, and Coinbase Global Inc. (NASDAQ: COIN) was up nearly 8% on the day.

The rising tide in crypto is lifting everyone’s ship, but what spawned Monday’s big move?

More Institutions Are Backing Crypto

A few years back, I predicted the next big wave in crypto would be powered by large institutional involvement. A big driver behind my prediction was a long conversation I had with Keith Bear, former vice president of global financial markets at IBM.

At the time, Keith shared with me that today’s blockchain networks require a leap of faith. Participants have to believe in the trustworthiness of random anonymous users.

That’s a problem for many folks, and not without reason. We can’t seem to even go a couple weeks without hearing about the latest and greatest cybersecurity breach.

For cryptocurrencies and their underlying blockchains to flourish, we need more trust. A company like J.P. Morgan isn’t going to rely on some anonymous tech guru with a supercomputer to verify a multimillion-dollar client transaction. But J.P. Morgan would trust a blockchain network backed by the likes of IBM, Amazon, and other companies.

As Keith further explained, we are at a new pinnacle in the development of blockchain tech — one that eliminates a big impediment to scaling out this tech, allowing for true global adoption across most major industries. According to Keith, that’s exactly what IBM and other partners are collectively working on right now.

It’s this type of institutional involvement that’s now powering the current surge. In the span of just a few months, we’ve had Tesla, Amazon, and Twitter all make announcements that they were considering crypto and blockchain for various uses. Moreover, there are rumors that President Joe Biden may be the first U.S. president to support the introduction of a digital dollar.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Of course, all of this is still very raw news and how all these speculative headlines play out is anyone’s guess, but the underlying trend is clear. It’s go long on cryptocurrencies and crypto-related tech — despite what the likes of crypto bears like Peter Schiff have to say…

Sounds like sour grapes to me.

How can you trust someone who throws shade on high-yield investments in favor of one that’s stayed flat for four years running?

Now, if you’re intrigued by the crypto and blockchain story, you should know there’s more than one great way to make money off these assets.

Two Great Ways to Make Money in Crypto

There are a number of ways folks have cashed in big returns over the years in the crypto space. The easiest way is to invest in popular and established cryptocurrencies like Bitcoin and Ethereum, which is something I highly recommend you do (we’ll explain why later this week).

Much like a stock that you believe in long term, many of these established coins have plenty of upside left as adoption and utility increase. Using technical patterns, you can time your entry, buy in on the dips, and further maximize your returns.

Another way to earn money in crypto is to mine cryptocurrencies. Cryptocurrency mining, or crypto mining, is a process in which transactions for various forms of cryptocurrency are verified and added to the corresponding blockchain digital ledger. To put into scale just how “big” cryptocurrency mining has become, think about the chipmaker NVIDIA Corp. (NASDAQ: NVDA). NVIDIA has grown 10 times over, mostly thanks to sales of its graphics processing units for the sake of crypto mining.

Why get left out of the profit party?

Of course, simply investing in popular cryptocurrencies or mining coins and tokens aren’t the only ways folks can generate newfound wealth in this market.

Which is why later this week my colleague and market analyst Chris DeHaemer will be revealing a host of brand-new and inventive ways you can start earning fast cash with minimal startup costs.

Stay tuned.

To your wealth,

Sean McCloskey

Editor, Energy and Capital

After spending 10 years in the consumer tech reporting and educational publishing industries, Sean has since redevoted himself to one of his original passions: identifying and cashing in on the most lucrative opportunities the market has to offer. As the former managing editor of multiple investment newsletters, he's covered virtually every sector of the market, ranging from energy and tech to gold and cannabis. Over the years, Sean has offered his followers the chance to score numerous triple-digit gains, and today he continues his mission to deliver followers the best chance to score big wins on Wall Street and beyond as an editor for Energy and Capital.

@TheRL_McCloskey on Twitter

@TheRL_McCloskey on Twitter