Investor Report: "The Top 3 Stocks For Lithium’s 4,000% Rise"

Goldman Sachs is calling it “the new gasoline.”

The Economist has called it “the world's hottest commodity.”

Energy experts have dubbed it the "oil" of the future.

I'm talking about lithium: a one-of-a-kind element used in consumer electronics, computers, and communication — think everything from cellphones all the way up to electric vehicles… basically anything necessitating a compact, rechargeable power source.

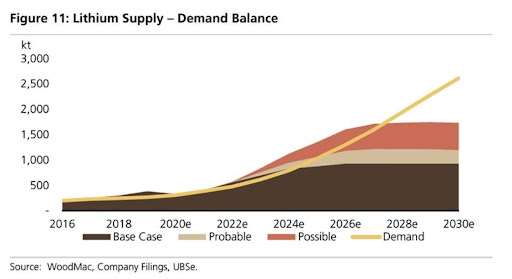

Demand is going to soar in the coming years. The main driver for this explosive lithium growth is the rechargeable battery sector.

Rising prices of lithium, cobalt, and carbon are not a bubble. They are underpinned both by rapid growth in electric vehicle sales and tight supplies.

Electric vehicles (EVs) are expected to make up 35% of the automotive market by 2040. Just as importantly, Elon Musk’s prediction that long-range EVs would be available for less than $30,000 by 2023 came true – two years early. Several long-range models from Audi, Nissan and Hyundai already cost less than $30,000 after tax credits.

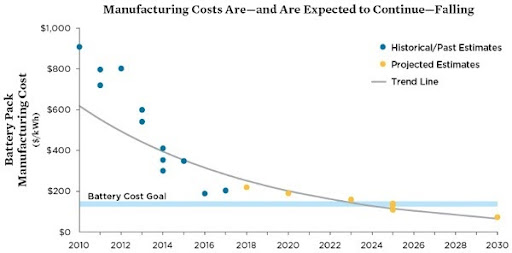

Again, this all goes back to batteries, which have seen a huge reduction in cost that will continue.

Estimates indicate that the cost of “fueling” electric vehicles is a fraction of the cost for conventional gasoline vehicles. The cost to charge an EV is around $0.14 per kilowatt-hour, while a gallon of gas currently averages $3.38.

The average lifetime maintenance cost of an EV is roughly $4,600, while the average gas car costs twice as much – $9,200 on average – in mechanic bills over its lifetime. .

In addition to getting cheaper, these batteries are also getting more efficient. New and second-generation plug-in models can go farther on a single charge than their predecessors. And this is key.

The Tesla Model S has a 400-mile range. Audi's Q4 e-tron is up near 300 miles of range and is already considered the cheapest electric Audi, starting at around $49,800.

These technological advancements have accelerated sales. Furthermore, they’ve demonstrated a significant competitive advantage for car companies which master them. It’s a race to build the best battery. The manufacturer with the most efficient, cost-effective and potent battery wins.

Furthermore, such batteries are essential for renewable energy sources, specifically wind and solar. The need to store power for prolonged periods requires the kind of industrial-grade capacity that only advanced lithium batteries can deliver. That's added another nice tailwind to lithium demand.

Data compiled by Allied Market Research suggests that the global lithium-ion battery market is expected to grow at a compound annual growth rate of 18% to reach $129.3 billion by 2027.

So how can investors play it?

The Lithium Stocks We're Watching

Lithium Americas (NYSE: LAC) is one of the most compelling names in the space right now. The company’s Thacker Pass project in Nevada is considered the largest lithium deposit in the United States, and in September 2025 it caught major headlines when Washington floated the idea of taking up to a 10% equity stake in the company. That news alone triggered a massive rally in the stock. While Lithium Americas still faces challenges from weak prices and the high costs of development, government backing could be the catalyst that sends it into a different league entirely.

Then there’s Albemarle Corporation (NYSE: ALB), the world’s largest lithium producer by revenue and one of the few big names with the scale to weather this downturn. Despite softer pricing, Albemarle recently posted a quarterly profit by slashing costs and streamlining operations. The company continues to hold valuable assets in Chile’s Salar de Atacama and Nevada’s Silver Peak mine. It may not be a pure play, but it has the financial strength to ride out the cycle — and it’s often the survivors of down markets that deliver the best upside when things turn.

Finally, we can’t ignore Rio Tinto (NYSE: RIO). Known globally as a mining giant, Rio Tinto made a major statement in early 2025 when it absorbed Arcadium Lithium — the recently formed giant created by Livent and Allkem. By integrating Arcadium, Rio Tinto instantly vaulted itself into the ranks of the world’s biggest lithium players. This gives investors a chance to own a blue-chip miner with direct exposure to the lithium megatrend, while still benefiting from the diversified earnings base of one of the most established names in global mining.

Some Bonus Picks

Pilbara Minerals (OTC: PILBF) developed the Pilgangoora project in the iron ore-rich Pilbara region of Western Australia. The lithium-tantalum project is 100% owned by Pilbara and is one of the largest hard-rock lithium deposits in the world.

The Pilgangoora project is currently in Stage 2 of a three-stage expansion process for the mine. Company reports have stated that it is waiting until “such time that market demand and/or participation of a partner at Pilgangoora is sufficient to justify its development.”

Both stocks have posted impressive performances this year…

As lithium demand increases over the years, Pilbara and Orocobre’s stock prices should follow suit.

There's also the Global X Lithium & Battery Tech ETF (NYSE: LIT), which seeks to track lithium's price movement.

The fund is a great way to track the overall lithium market while investment and demand grow over the next few years into unparalleled territory in the coming decades.

Included in the holdings of the ETF are miners, chemical companies, battery manufacturers, and other industrial companies.

By diversifying the exposure to lithium, the Global X Lithium & Battery Tech ETF provides investors with less risk and the potential for long-term reward.

And our last bonus pick is Sociedad Química y Minera de Chile S.A. (NYSE: SQM). The company plays a crucial role in the global lithium market, supplying a significant portion of the lithium used in electric vehicle (EV) batteries, making it integral to the growing renewable energy sector. The company also pays a sturdy dividend, currently above 4%.