So you think the disaster at Fukushima has nuclear energy on the ropes in the energy heavyweight title bout…

You say this is the event that finally changed global opinion. You point to Germany and its plan to close all nuclear power plants by 2022…

And you sound like an optimistic young child.

The truth is the events in Japan didn’t deliver a death knell.

To the contrary, they inspired a new dedication to build safer, more sustainable nuclear plants.

Don’t get caught up in the “this is the end of nuclear” hype. You’ll miss out on some serious profits.

Addressing Germany

Yes, Germany voted to phase out all 17 of its nuclear plants by 2022.

I did some math, and I found out that means another decade worth of nuclear operation there.

After I did that math, I figured I’d keep going…

There are 441 nuclear reactors in the world. Germany’s 17 gives them 3.8% of the world total — hardly industry-ending stuff.

And once I knocked out that complex equation, I did another…

There are currently 60 reactors being built worldwide, none of which have been canceled as a result of Fukushima.

It was difficult, but I determined that’s enough to offset Germany’s eventual loss 3.5 times over.

And companies operating in Germany are already picking up business elsewhere. Hitachi is filling the void by committing to projects in other areas. It’s just submitted a proposal to Lithuania, which is still desperately seeking nuclear.

I think Prime Minister Andrius Kubilius was looking right at Merkel when he uttered:

For Lithuania and the whole region it is important to have independent capacity to generate electricity. We are choosing a path that we believe is the best for Lithuania and for the whole region.

And then there’s all this…

It’s Relatively Safe

Compared to other mainline fuels, nuclear actually offers a pretty safe track record.

The human brain has evolved to latch on to big events and not the mundane. So one explosion in the Ukraine with 31 direct deaths resonates more than the 500,000 people per year in China whose deaths are attributed to coal pollution.

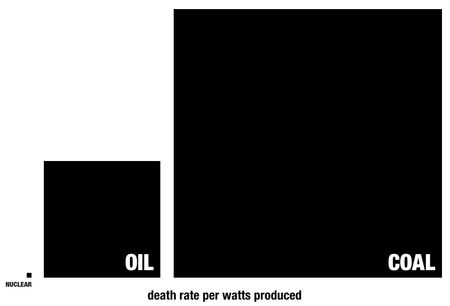

Human thought and decision-making expert Seth Godin crunched the numbers on deaths per fuel by terrawatt-hours generated. You can find the full rationale and data here, but this was the ultimate result:

Nuclear even came out safer than hydro and rooftop solar.

The IEA Says So

Every year, the International Energy Agency releases its World Energy Outlook. The 2012 edition is due out in November, but Executive Director Nobuo Tanaka (who I’ve spoken to directly at private conferences) recently appeared before the European Parliament to give a preview.

I wasn’t there, so I’m going to give you the summary from New Europe, which has been covering the bloc since it was created in its current form in 1993. According to them, the IEA will tell the world in November it:

… expects that nuclear power plants (NPPs) currently under construction will stay on track, while older plants will be decommissioned. However, the political debate is proving detrimental only in OECD countries, which are more likely to reduce the use of atomic energy, while others such as China, will remain determined to exploit it.

Tanaka added that a complete phaseout of nuclear power would create enormous risks for Europe’s energy security.

{$custom_SIGNUP_EAC}

No Caution Flag

But the most convincing evidence the nuclear industry will keep on chugging is the fact that the nuclear industry has kept on chugging.

Construction on new plants in the United States continues to move forward, with two scheduled to come online in Georgia in 2016.

Westinghouse says its first AP1000 reactor is scheduled to come online in China by 2014, at the latest.

China currently has 10.8 gigawatts of nuclear; the goal is 80 GW — a 640% increase — by 2020.

Indian President Pratibha Patil flew to South Korea this week and signed a nuclear cooperation agreement. Keep an eye on Korea Electric Power (NYSE: KEP) as it makes more connections like this. India currently has 20 reactors, but wants to double that in the next two decades.

Necessity and Innovation

And, of course, let us not forget about the mother of all invention.

Dealt a serious blow of lemons, the global nuclear industry is adding sugar and water.

In the United States, the Nuclear Regulatory Commission has already formed a task force to identify possible safety improvements. They’ve already made improvement recommendations, like having greater levels of backup power, better ventilation, and cooling spray for spent fuel, that could start to be enacted as soon as November.

To prove its nuclear ambitions haven’t been muted, China is continuing with advanced research at its Institute of Atomic Energy. Last week, it announced it’s hooked up a “fast breeder” reactor to the power grid outside Beijing.

The advantage of a “fast breeder” reactor is that it produces more plutonium than it needs to run while reducing radioactive waste. Only eight countries have developed this type of reactor, and this latest nuclear advancement came after it learned how to reprocess spent fuel in a reactor this past January.

These advancements are without mentioning things like modular reactors and new fuel additives (specifically beryllium, which I’ll be telling you more about shortly) that will make nuclear safer and easier to deploy in a world that facing larger and larger gaps between energy demand and supply…

Allow me to make a statement without any qualifiers: The nuclear industry is not dead.

I’ve talked to some insiders who see uranium supply problems by the end of the year.

The time to buy is now, while the sheeple still think Germany’s on to something.

Start with currently undervalued uranium stocks like Uranium Energy (AMEX: UEC) and Uranerz (AMEX: URZ), and keep an eye out for the new nuclear report I’ll be issuing shortly.

Call it like you see it,

![]()

Nick Hodge

Editor, Energy and Capital