At this very moment, the energy market is changing.

New volumes of fossil fuels to be had on fronts in the U.S. and throughout the world have initiated changes in how we value oil, gas, coal, and other forms of finite energy.

The focus of this post will be to provide a greater understanding of natural gas versus oil with a more specific focus on prices and investing.

So as the new glut of supply in both oil and gas – especially in the United States – changes the market we should start with the most simple differences.

Natural gas is priced by MMBtu while crude oil is priced by the barrel or about 42 gallons.

Since oil is a global commodity that is shipped relatively easily, crude is priced on a global scale. This is a good thing in the sense that discrepancies in price are few, and thus investments are more simple to track.

However, this isn’t always good since oil prices are tied to several complex factors and geopolitics that can create surges and depressions based on the whims of unstable forces.

A great example of this happened this summer when ISIS took over the northern sections of Iraq and oil skyrocketed above $115 per barrel.

As for natural gas, its price is much more localized since it’s harder to transport overseas.

This creates massive discrepancies depending on where natural gas is harvested: for the United States it may cost four times less than in, say, Japan, where gas is in high demand after the shut down of nuclear power plants.

Natural Gas Long and Short

Speaking of natural gas, prices have very predictable long and short term swings.

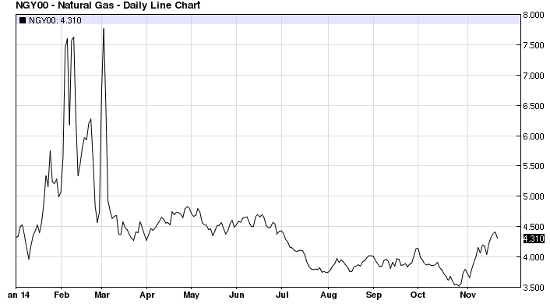

For example, take a look at this chart that shows Henry Hub natural gas prices for the year to date…

As you see above, the price of natural gas doubled during the cold months in January, February, and March, then settled down over the summer and into the fall.

Typically the summer and fall are when gas drillers work hard to replenish stores before the winter when residential and commercial heating soaks up most of the gas.

According to the EIA, 61% of homes in the U.S. use natural gas for heat, so these cold months prove to be tougher on the energy bills and bullish for investors who get in on natural gas at the right time.

Now I know last year’s winter was colder than average, and even though some are predicting more mild conditions this year, the higher volume of usage during the cold months in 2013 and 2014 has left gas in storage at record lows.

Companies have struggled to replenish it too…

As a result any long cold spells this winter will inevitably alter the price of natural gas favorably for investors.

As for the long term, U.S. natural gas will benefit from new supply as demand in foreign markets grows fast.

The European Union – facing pressure from Russia – and Asian countries craving growth without the smog problems caused by coal like China, India, and Taiwan all see higher natural gas prices per MMBtu than are found in the U.S. where supply is in a glut.

Add to that Japan, where gas prices can reach above $16 per MMBtu in the colder months, and U.S. producers are looking at a valuable market.

Once LNG exports are up and running by the end of next year, the price of natural gas will be favorable to investors who look for long term value.

Plus when you add that natural gas has brought certain sectors of manufacturing back to the U.S. such as fertilizer, chemicals, and plastics, the case is even more bullish in the long term.

Oil’s Short Term Losses

While natural gas presents great short term value with winter coming and long term value with exports and manufacturing, oil’s story is a little different.

Right now, as OPEC and Saudi Arabia lower the price to Asian countries without cutting production, oil has plummeted since its summertime highs.

Take a look at the price of Brent Crude, the global benchmark, for the year to date…

Although oil prices hovered around $100 per barrel since the end of the recession, after highs during the summer, the price and supply tinkering by OPEC members caused the massive losses in the fall months.

Because of this, the short term value of oil stocks plummeted – even in the United States – and most oil investments took a hit.

In so many words, the short term outlook for oil isn’t good.

The only positives we can take from the drop in prices are that we don’t have to pay as much when we fill up our car and that the drop has created long term value.

See, the fact remains that oil is a finite resource that is always in high demand. This means it will go up until companies stop drilling for it which isn’t going to happen anytime soon.

Now that oil stock prices are the lowest since the financial crash and recession, investors can find cheaper shares that are undervalued. Once the price returns to its normal near $100 a barrel, the stock prices will rise again.

The only trick here is being able to know which companies will make it through without too much damage and when the price of oil will actually go back up.

The previous statement is much the same with natural gas too.

When we start exporting gas – and maybe even oil – the successful stocks will be the one’s that have a hand in the growth and sale of the commodities.

For example, Cheniere Energy (NYSE: LNG) and its suppliers will benefit from gas exports. So too will the companies building and operating the infrastructure that makes shipment and extraction possible.

As for oil, the companies that are going to rise will be those that have significant reserves and incurred less losses during the current bear market.

Finding these opportunities is difficult, but will certainly be rewarding once the long term rationale improves and major projects come to fruition.

The only question is will you be on the right side of the fence on time.

Good Investing,

Alex Martinelli