Some people gloss over when the subject of Peak Oil is brought up.

Some simply skirt the issue, while others make arguments in their favor using smoke and mirrors with fossil fuel production data…

One CEO recently went to far as to call the entire theory “baloney.”

According to the interview:

Frankly, I think peak oil is baloney, and you can quote me on that. The potential reserves, especially on the natural gas side, are just tremendous.

I was just reading a report that even in a place like Argentina, shale gas reserves could be north of 700 trillion cubic feet. That could be another huge gas-producing region. There’s plenty out there. I don’t buy peak oil or gas.

But there’s a big problem with using the “tremendous natural gas reserves” in one’s argument against the reality of Peak Oil…

For starters, the issue has never been whether there’s “plenty” of oil and gas out there. Of course there is. Nobody is arguing otherwise.

Granted, we may question the quality of global reserves and the ever-increasing cost to extract them, but there’s no doubt that we aren’t in danger of running out of underground crude.

Cut the Baloney

So, Peak Oil is a myth…

Really?!!

Earlier this week, one my colleagues talked about how most people are uninformed and misled when it comes to total global oil production. They’re unaware that it isn’t really crude oil — that the 90 million barrels being produced daily is a combination of total liquids.

But don’t take our word for it; check out the EIA’s own data.

Within the last eight years, global production of crude oil (including lease condensate) increased 2.3%. That’s it.

But hey, maybe the aforementioned CEO wasn’t referring to a global peak in oil production…

After all, the mainstream media has finally caught wind of the good, old-fashioned oil boom taking place in the lower 48 states. It only took half of a decade for them to figure it out. Now all we need is for someone to mention it to the United States.

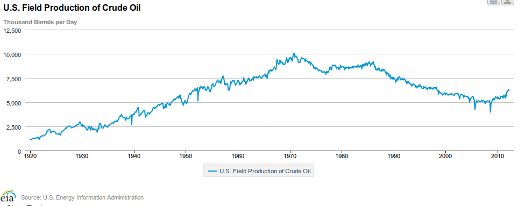

Here’s a chart we’ve seen all too often:

See that little bump at the tail end of the chart?

That represents the best news in the U.S. oil industry since the early 1970s.

Even the most optimistic of analysts will tell you there’s still no chance of topping our peak production of 10.44 million bbls/d, set in November of 1970.

If we add another two million bbls/d of Bakken oil and perhaps another million barrels per day from Texas fields, that would top us off at 9.2 million barrels per day.

It paints a pretty optimistic future for the U.S. oil industry.

However, it doesn’t take a very crucial factor into account — that is, falling output nearly everywhere else.

Sure, North Dakota may be pumping two and a half million barrels per day, but it will also be offsetting the irreversible decline taking place in both Alaska and California. Soon, production in both states will drop below 500,000 barrels per day.

Apples and Oranges… for How Long?

That brings us to the other serious problem of using our cheap, abundant supply of natural gas as a means to dismiss Peak Oil.

It’s another common connection that people (many of whom who share this herd mentality are also found in the investment community, unfortunately) make too hastily.

They see the chart below and they think to themselves, “Hey, a flood of cheap natural gas will solve our oil issues!”

If only that were the case, dear reader, many — if not most — of our energy problems could be shelved for decades.

Just because we have “tremendous reserves of natural gas” does not mean we can kiss our oil addiction goodbye. Not in the slightest.

Here’s why…

In order to make any sort of dent in our consumption habits, we need to focus on the transportation sector, which, as you can see above, is dominated by petroleum.

This simultaneously gives us the chance to capitalize on the biggest opportunity in the North American natural gas market.

First, let’s look at where our cheap natural gas is being put to use:

The EIA doesn’t put much faith in the transition to natural gas by the transportation sector… but I have a feeling that sooner or later, they’ll make a few changes to their projections.

I’ve called this very transition the holy grail in natural gas investing.

This is your classic catch-22: Car companies are hesitant to build more natural gas vehicles without the proper infrastructure to support them (think fueling stations, etc.), while companies are reluctant to put that infrastructure in place without a sufficient number of NG-powered vehicles on the road.

So, who’s going to make the first move?

Well, the good news in all of this is it doesn’t matter.

Natural gas is quickly becoming one of our last cheap sources of energy. Even if prices were to double to $6/Mcf, we would still consider it inexpensive.

If you haven’t already recognized the opportunity before us, I suggest you take a second look at new ways to invest in our domestic gas boom.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.