“My next car will definitely be a Tesla,” my Uber driver said with great enthusiasm.

As he was driving me from the Hyatt in Newport Beach to John Wayne Airport, a Tesla P85D quietly flew passed us.

It was black, shiny, and clearly driven by an individual that was in a hurry. He must’ve been doing at least 90, and this 20-something part-time Uber drive could barely control his excitement.

While I certainly shared his enthusiasm, I was unsure of how a part-time Uber driver (I believe he was a college student driving for Uber to make some extra cash) would be able to afford an $80,000 car. But then I realized that by the time this guy gets a new car, he won’t need $80,000 to buy a Tesla. He won’t even need half that.

You see, Elon Musk’s next big rollout — following the Model X all-electric SUV — will be the Tesla Model 3, which is set to debut next year with a $35,000 price tag. And rest assured, it won’t lack much more than space compared to the Model S. In fact, I’ve heard it’s basically just a smaller version of the Model S.

In any event, the $35,000 price tag on the Model 3 is the actual price — without any incentives included. Throw in the $7,500 federal tax credit, along with California’s state tax credit of $2,500, and my Uber driver will be able to pick up a shiny new Tesla for $25,000.

Not a bad deal considering he’ll save at least another $10,000 on gasoline during the first three years of ownership (and all Tesla Superchargers are free to Tesla owners). Figure that into the equation, and you’re looking at a price tag of $15,000.

Of course, we can’t forget that with a Tesla, there are no oil changes or smog checks either. And because it uses regenerative braking, the brake pads can last between three to five years longer than those on a typical internal combustion engine vehicle. Overall, over the course of three years, you’re probably looking at another $1,500 in savings on maintenance.

That brings us down to $13,500 for a Tesla!

I believe the cheapest internal combustion vehicle you can buy today is the Nissan Versa, which will cost you about $12,800. But of course, when you figure in gas and maintenance costs, it quickly becomes much more expensive.

Just Kidding!

Okay, so admittedly, I went a bit over the top just now.

Yes, the new Tesla Model 3 will be priced very competitively. But when looking at pricing, I actually try to exclude any special tax incentives. If you figure those into the equation, you’re not really getting an accurate read on pricing.

So if we take that same Model 3 and exclude the tax incentives but still include gas and maintenance savings (which are absolutely relevant), that puts us back up to $23,500.

Now, let me ask you this…

Would you pay $23,500 for what is basically a smaller version of the car in the image below?

Before you answer, keep in mind that you will still be limited in driving range.

Right now, I can drive my Prius from Washington, D.C. to Boston on a single tank of gas. In a Tesla Model 3, however, which will deliver 250 miles per charge, I’d only get as far as New York City.

I say “only” because I’m being a bit sarcastic.

Being able to drive from Washington, D.C. to New York City in an electric car — without having to stop to recharge — is pretty damn impressive. Especially if you get to do it in a Tesla.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Change is upon us

The reason I did these quick calculations was to illustrate that the two biggest obstacles to electric vehicle integration — price and range — are quickly being overcome. Hell, they’re being torched!

Next year, we’re going to see an electric car that will be competitively priced against similarly styled internal combustion vehicles and will provide nearly every daily commuter with enough “fuel” (i.e. battery power) to get to and from work or school.

Now imagine where we’ll be by the end of the decade!

My engineering contacts tell me 300 miles per charge should be the standard by 2020, and according to UBS, electric car sales should soar after an “expected rapid decline in battery cost by more than 50%.”

With the dual threat of cost reductions and increased range, the highly disruptive breakthrough of electric vehicles is now in place where a major ramp-up is inevitable.

In fact, consider what was recently written at Oilprice.com in an article entitled, “Electric Vehicles to Become Mainstream in Short Period of Time.”

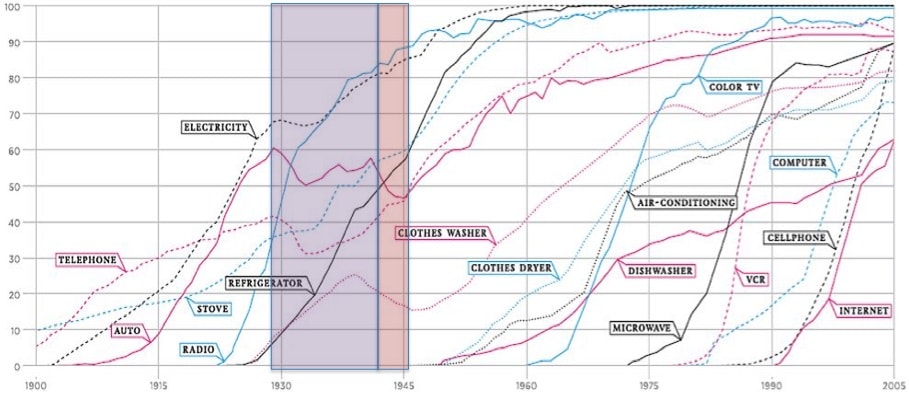

Consider the ramping up of some of the most basic items that have conquered the American market over the past century. Refrigerators went from a luxury item to 60 percent household penetration during the Depression and World War II. Technologies we used to live without including PCs, the Internet, and cell phones have become an integral part of daily life.

We are about to find out if electric vehicles can make their mark and become mainstream. The launch sequence and liftoff phase (now barely underway) will soon reveal the extent of their fuel supply, i.e. How much interest will consumers have in EVs when a 200-mile-per-charge car costs less than $25,000? When a 60 kilowatt-hour (kWh) battery costs $9,000, there will be plenty of room in the budget to build a lightweight car around it.

At any price, the cost of ownership falls by 75 percent (not including cheaper insurance and maintenance); gasoline miles costing 12 cents each (at the current mileage standard with $3 per gallon) cannot compete with electric miles costing 3 cents or less.

My friend, if you’re a regular reader of these pages, you know I’ve been bullish on electric vehicles since 2005 — back when hardly anyone knew a company called Tesla even existed.

And here we are today, with electric vehicles being nearly ubiquitous in terms of any discussion regarding the auto market. These days, Tesla models, Volts, LEAFs, and a handful of compliant electric cars are just as easy to find on a highway as roadkill — an ironic foreshadowing of what lies ahead for internal combustion.

There is no doubt that we are at the dawn of one of the biggest transitions we’ll ever see in personal transportation. Ten years from now, I’ll be surprised to see many internal combustion vehicles even being manufactured.

Hell, most kids born today will probably never even know what it’s like to fill a gas tank, get an oil change, or smell exhaust.

Change is upon us, dear reader. Embrace it, enjoy the benefits of it, and — by all means — profit from it!

To a new way of life and a new generation of wealth…

Jeff Siegel

Jeff is an editor of Energy and Capital as well as a contributing analyst for New World Assets.

Want to hear more from Jeff? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@JeffSiegel on Twitter

@JeffSiegel on Twitter